Quant Advisor

Providing quantitative solutions for digital asset investors to backtest, automate, and monitor trading strategies and Crypto funds.. All rights reserved to clients.

Strategy Backtest

Whether you're using fundamental or technical or event-driven strategies, you probably want to see how your strategies perform in history and various markets.

From AlgoOne, you can apply, study, test, and prove your strategies, which can help increase your confidence to succeed in real market.

Automated Trading System

Our technology minimizes slippage to under 0.02%, swiftly executes orders across various timeframes without impacting market prices, and automates trading to reduce human error.

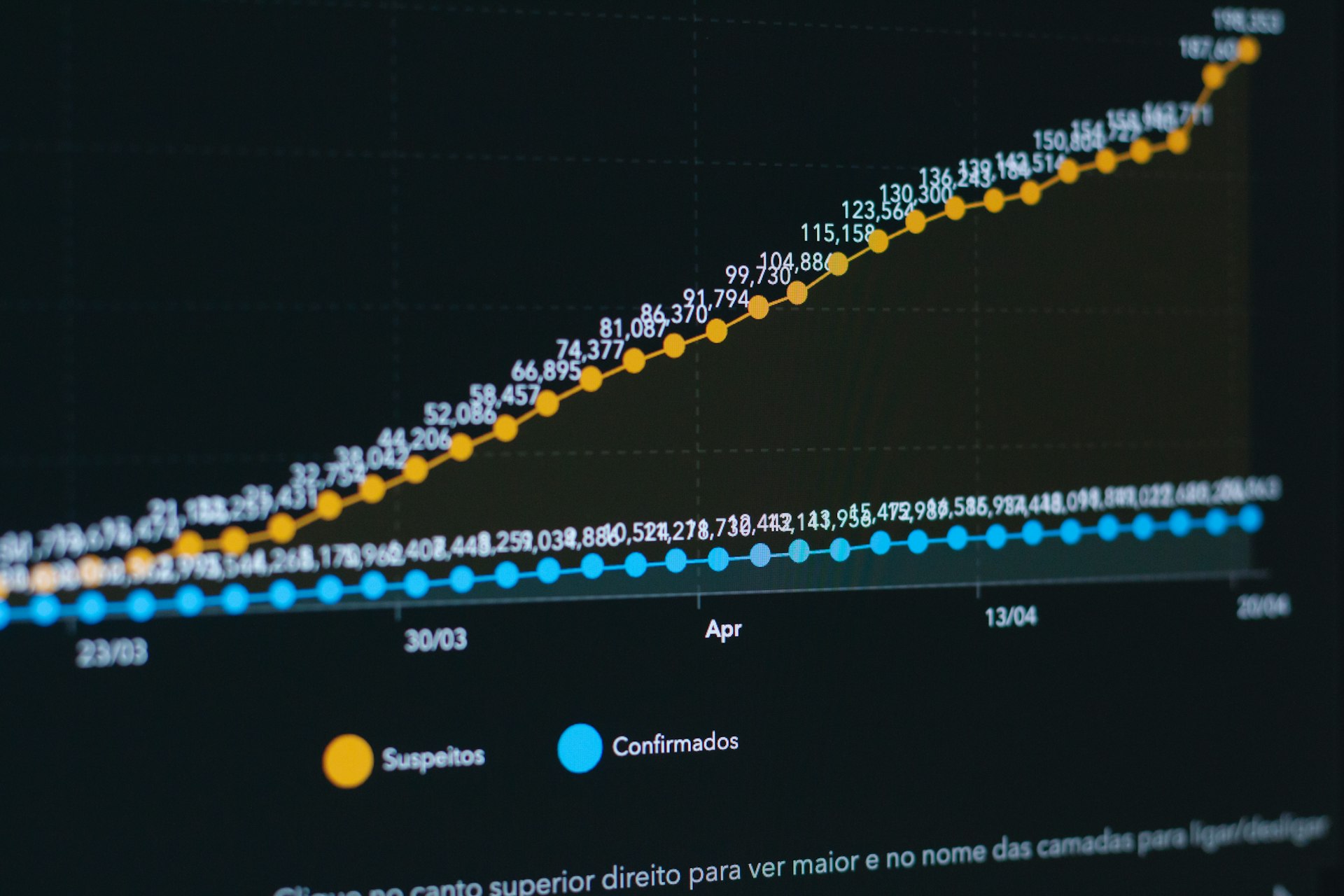

Smart Money Flow

Our technology can effectively track smart money flow through data from whale addresses, on-chain data, exchange, and Twitter sentiment.

Strategy Due Diligence

Evaluate Strategy Overfitting Risks, Estimate Strategy Slippage / Liquidity Impacts, Suggest Improvement Options

Individual / Institutional Investor

AlgoOne provides you with convenient and reliable quantitative advisory services.

Trade Support

Order Book/Futures/Options,

Arbitrage/Directional Strategies, RESTful API, WebSockets, etc

Tech Support

Rolling Regression,

MySQL, MongoDB, InfluxDB,

Python, R, Go, C++, JavaScript,

Linux, Confluence, JIRA,

Git, R, Java, PHP/Laravel, AWS,

Docker, Jenkins

Flexibility

We can work overtime,

if you're rushing for deadlines.